dividend history & policy

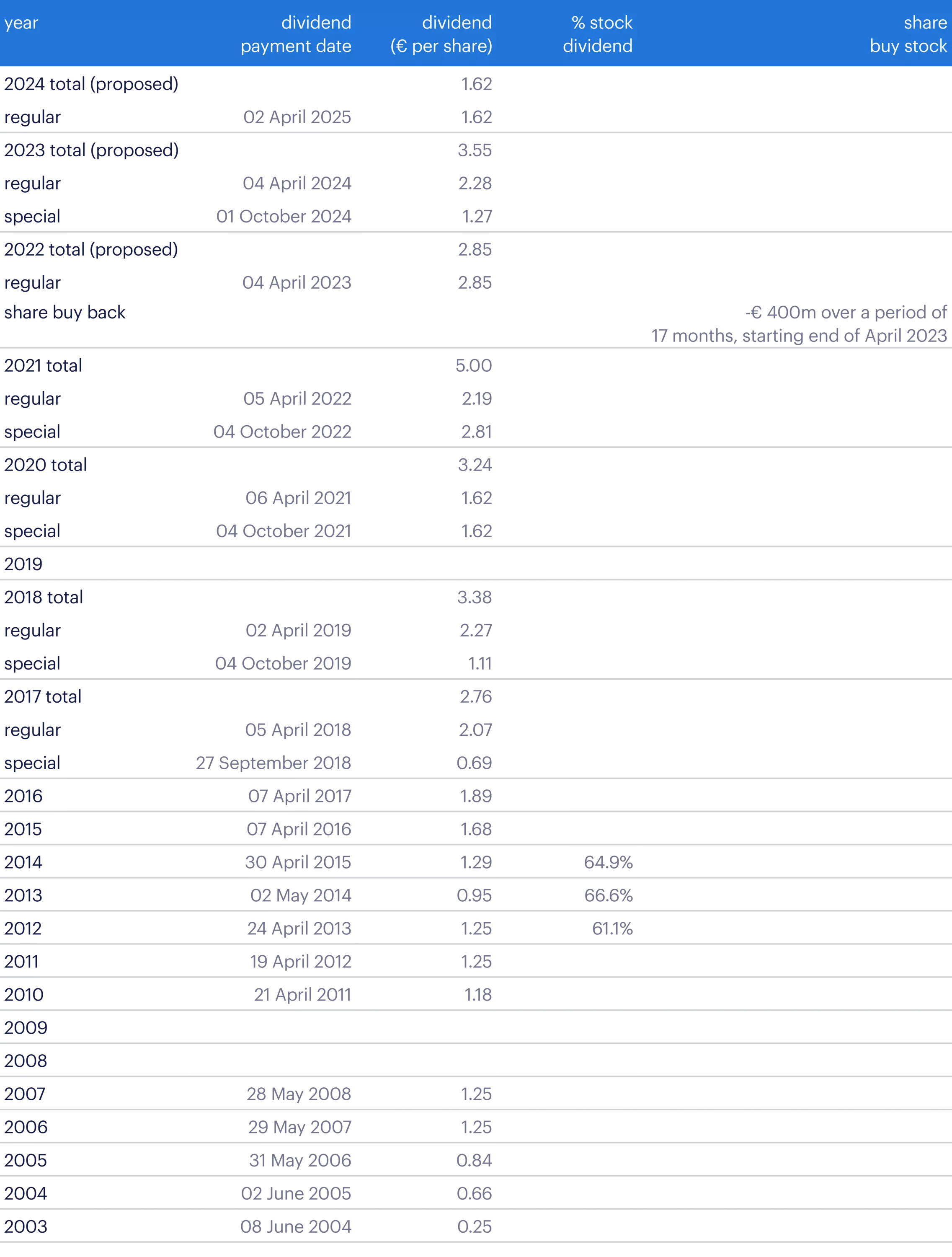

Randstad's dividend policy is part of our overall capital allocation policy and consists of two elements. First, there is the ordinary cash dividend. We aim for a flexible payout ratio of 40% to 50% of net profit adjusted for amortization and impairment of acquisition-related intangible assets and goodwill, integration costs and one-offs.

In addition, we have set a conditional ordinary cash floor dividend of € 1.62 per share. This baseline dividend level will be maintained even when the 40-50% payout ratio is temporarily exceeded, barring (i) seriously adverse economic conditions, (ii) material strategic changes to the sector, and (iii) a material deterioration in our solvency and liquidity ratios.

Secondly, we have set discretionary additional returns to shareholders in the event of a leverage ratio below 1.0 (excluding lease liabilities) through either (i) a special cash dividend or (ii) share buybacks.

dividend history.